Murray Gell-Mann is a theoretical physicist and was the winner of the Nobel Prize for Physics in 1969 for his work on the classification of subatomic particles. Gell-Mann is a Professor of Theoretical Physics, Emeritus at Caltech and a Distinguished Fellow at the Santa Fe Institute, which he co-founded in 1993. Caltech writes: “Gell-Man earned his PhD in physics at MIT and went on to study at Princeton under Oppenheimer, has devoted his scientific career to finding the ultimate elementary building block of matter, a search that has been compared to looking for the bottom of a well extending into infinity. The quest for the bottom of the well has led Gell-Mann through an Alice-in-Wonderland world of ‘strangeness’ and the ‘eightfold way’ to the wondrous ‘quark.’” A New York Times profile describes the range of his skills and interests: “He is a director of the John D. and Catherine T. MacArthur Foundation, member of the Council on Foreign Relations, adviser to the Pentagon on arms control, collector of prehistoric Southwest American pottery, amateur ornithologist, to name a few.” He is the author of the book The Quark and the Jaguar: Adventures in the Simple and the Complex.

- “Any entity in the world around us, such as an individual human being, owes its existence not only to the simple fundamental law of physics and the boundary condition on the early universe but also to the outcomes of an inconceivably long sequence of probabilistic events, each of which could have turned out differently.” “The fundamental law does not tell you exactly the history of the universe, but only gives probabilities for a gigantic number of alternative histories of the universe.”

Perhaps the most important lesson I have learned from Gell-Mann is phrased perfectly by Howard Marks: “Many futures are possible, but only one future occurs.” In making that statement Marks gave a hat tip to Elroy Dimson who said: “Risk means more things can happen than will happen.,” but I imagine both he and Dimson have read Gell-Mann. Marks embellished on this idea further by saying “the future should be viewed not as a fixed outcome that’s destined to happen and capable of being predicted, but as a range of possibilities and, hopefully on the basis of insight into their respective likelihoods, as a probability distribution.” This idea that the future is should be viewed as a probability distribution was made even more valuable for me when I combined it with Charlie Munger’s ideas about the value of knowing what you do not know. These ideas were made even more valuable by the ideas of Richard Zeckhauser, which were best brought to life for me by a wonderful paper entitled: “Investing in the Unknown and Unknowable.” I could go on identifying other related ideas from other people, but I think you see my point. When you encounter a really big idea and it is reinforced by ideas from other great minds, it becomes even more powerful and useful.

- “We live in a universe with an enormous amount of uncertainty. Quantum mechanical law can only give probabilities for alternative-different alternative histories of the universe. And all the things that are not predicted are nevertheless very important for determining the outcome. So that the particular events of the history of the universe are co-determined by the fundamental law and a whole series of intrinsically unpredictable accidents.” “Quantum mechanics gives us fundamental, unavoidable indeterminacy, so that alternative histories of the universe can be assigned probability.” “Sometimes the probabilities are very close to certainties, but they’re never really certainties.”

Gell-Mann’s point about inevitable uncertainty makes me think harder about the right way to make decisions in the presence of uncertainty. I like Zeckhauser’s definition of uncertainty, which makes clear that when potential states of the world are unknown, probability is not computable (ignorance) and that probability cannot be calculated if you do not know probably distribution (uncertainty). Almost all of life is uncertain since the probability distribution impacting the future is rarely known with certainty.

Howard Marks talks about these ideas in the context of investing is his latest letter:

there are two things I would never say when referring to the market: “get out” and “it’s time.” I’m not that smart, and I’m never that sure. The media like to hear people say “get in” or “get out,” but most of the time the correct action is somewhere in between. Investing is not black or white, in or out, risky or safe. The key word is “calibrate.” The amount you have invested, your allocation of capital among the various possibilities, and the riskiness of the things you own all should be calibrated along a continuum that runs from aggressive to defensive.

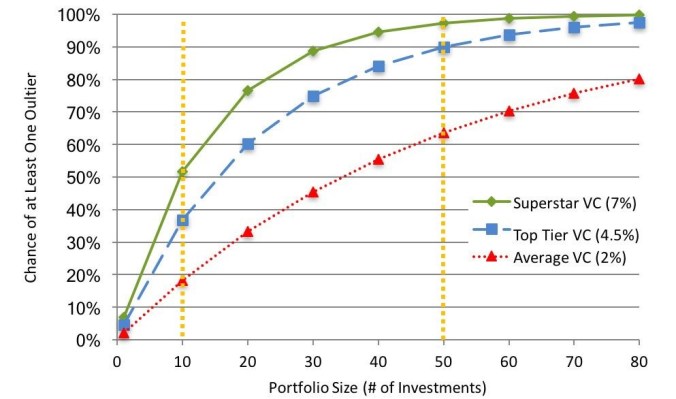

In one of two posts I have written on Marks I quoted him as saying: “The future you get may be beneficial to your portfolio or harmful, and that may be attributable to your foresight, prudence or luck. The performance of your portfolio under the one scenario that unfolds says nothing about how it would have fared under the many ‘alternative histories’ that were possible.” This point is fundamentally important since, as Michael Mauboussin points out, “Investing is a probabilistic exercise. In any probabilistic field, you have to recognize that even great decisions won’t work out all of the time, and sometimes poor decisions will work out well.” Nobody can be right all the time, but a person can learn to be wrong less often and in that process gain an investing edge. In other words, we can learn to have a better investing process even though we can’t be right all of the time. The more humble you are about making predictions in environments involving uncertainty and the more you include a margin of safety in making these decisions, the better off you will be. I don’t think that the first word that comes to mind when anyone describes me would be humble, but I try to be very humble about what I can predict. Another point made by Zeckhauser that is important is his emphasis on portfolio optimization as a skill needed by investors. The case of venture capital is an extreme example in the investing world, since “among the very top performing VCs, 4.5% of invested capital generates 60% of their funds’ returns.”

3. “In predicting things one always has only partial information.” “The existence of our galaxy, the development of our particular star, the sun, similarly depend on accidents, fluctuations that are intrinsically unpredictable. The emergence of the particular planets of our solar system, likewise. The details of the development of life on the Earth, likewise. The evolution of particular forms of life, likewise, depend on utterly unpredictable accidents.”

Gell-Mann’s ideas about unpredictable accidents are applicable in many contexts. For example, what Gell-Mann is talking about should make you more aware that if you are in favorable position in life a lot of that outcome is based on luck. People who ascribe moral superiority to themselves when outcomes are as based on luck as they are not being intellectually honest. Luck happens, both bad and good, and it has no moral dimension in terms of its outcome. The only moral aspect is related to the lucky giving back to the unlucky. As another example, Gell-Mann’s point reinforces the arguments Lean Startup advocates make about the value of conducting experiments using the scientific method in building a business or investing. If evolutionary outcomes depend on unpredictable accidents, then experimenting to test the evolutionary fitness of an idea is wise (another forms of portfolio optimization). The products and services created through this experimentation process that have greater fitness survive, and less-fit products and services die. Entrepreneurs have always experimented when creating or altering a business. What is different today is that modern tools and systems allow experiments to be conducted more cheaply and rapidly than ever before. Evolution has been put on steroids and is as a result faster and more powerful.

- “Think how hard physics would be if particles could think.” “What I try to do in the book is to trace the chain of relationships running from elementary particles, fundamental building blocks of matter everywhere in the universe, such as quarks, all the way to complex entities, and in particular complex adaptive system like jaguars.”

Mauro Gallegati and Matteo Richiardi write: “complexity is ubiquitous in economic problems (although this is rarely acknowledged in economic modeling), since (i) the economy is inherently characterized by the interaction of individuals, and (ii) these individuals have cognitive abilities…’ Consider how hard it was for forecasters to predict the lath of a hurricane. A recent Bloomberg headline read: “A $150B misfire: How Disaster Modelers Got it SO Wrong.” Imagine how much harder that modeling would have been if particles could think and had emotions. The more macro the forecast, the more the effort is like trying to predict the actions of a hurricane composed of thinking and emotional particles. Howard Marks explains: “We don’t know what lies ahead in terms of the macro future. Few people if any know more than the consensus about what’s going to happen to the economy, interest rates and market aggregates. Thus, the investor’s time is better spent trying to gain a knowledge advantage regarding ‘the knowable’: industries, companies and securities. The more micro your focus, the great the likelihood you can learn things others don’t.” Focusing on the simplest possible system (an individual company) is the greatest opportunity for an investor since a company is understandable in a way which may reveal a mis-priced bet. Howard Marks puts it simply: “We don’t make macro bets.”

Eric Beinhocker explains how theories can go astray if it is assumed that people behave like particles (i.e., do not think or have emotions):

My cartoonish summary would be that a group of very clever people in the late 19th century (Walras, Jevons, Menger, Pareto) wanted for very legitimate reasons to introduce mathematics and rigor into economics. But the tools they had at the time – primarily static equilibrium methods – were simply the wrong tools for the job. But they couldn’t have realized that at the time, and wrong tools were better than no tools, so their work set off a multi-decade creative burst of developing mathematical theories of the economy as an equilibrium system and shifting economics out of the philosophy department and into the new domain of social science. But as the neoclassical models became more elaborate they also became more detached from reality, and unfortunately the profession began to reward mathematical virtuosity more than empirical validity.

People in the real world are neither perfectly efficient nor fully rational because they think and have emotions. Markets do tend to discount information quickly, but they do not do so immediately and it rarely happens perfectly. Charlie Munger explains the implications:

“I think it is roughly right that the market is efficient, which makes it very hard to beat merely by being an intelligent investor. But I don’t think it’s totally efficient at all. And the difference between being totally efficient and somewhat efficient leaves an enormous opportunity for people like us to get these unusual records. It’s efficient enough, so it’s hard to have a great investment record. But it’s by no means impossible. Nor is it something that only a very few people can do. The top three or four percent of the investment management world will do fine.”

5. Complex adaptive systems are systems that can evolve or learn or adapt, and they would include-such systems would include biological evolution as a whole, the evolution of biological organisms on the Earth, the evolution of ecological systems on the Earth. The telical evolution that preceded the first life. That’s called prebiotic chemical evolution, which one can try to imitate to some extent in the laboratory. And then, many things that arose as a result of biological evolution, for example, individual learning and thinking. Human cultural evolution, including such things as the evolution of language, the global economy as involving complex systems. All of these have a great many things in common, because learning, adaptation, and evolution are all very similar phenomena.

I sometimes hear a person say that the study of complexity is not useful since it does not allow you to make specific predictions. The best answer to that argument is: how can knowing what you can’t predict not be valuable? For example, Charlie Munger wants to know where he will die so he can just not go there. This is just a part of Munger’s inversion approach to looking at the world and solving problems. The reason why so many great investors attend seminars and meetings at the Sante Fe Institute is that they want to know what they do not know and can’t predict. Charlie Munger believes:

“The way complex adaptive systems work and the way mental constructs work is that problems frequently get easier, I’d even say usually are easier to solve, if you turn them around in reverse. In other words, if you want to help India, the question you should ask is not “how can I help India,” it’s “what is doing the worst damage in India? What will automatically do the worst damage and how do I avoid it?” “Figure out what you don’t want and avoid it and you’ll get what you do want. How can you best get what you want? The answer: Deserve what you want! How can it be any other way?”

- “There is simplicity and complexity in the universe. The picture that we have, at least. Simple underlying laws, but very complex results. And among these complex systems in the universe are systems like us, that can process information.”

Michael Mauboussin describes the first of the three elements of “complexity” in this way: “the system consists of a number of heterogeneous agents, and each of those agents makes decisions about how to behave. The most important dimension here is that those decisions will evolve over time.” These heterogeneous agents might be ants, investors, businesses, genes or neurons. Mauboussin makes a key point here for investors and business people about the significance of this element: “markets tend to be efficient when the agents operate in a truly heterogeneous fashion and the aggregation mechanism is working smoothly. Diversity is essential, both in nature and in markets, and the system has to be able to take advantage of that diversity.” When diversity breaks down, as was the case during the internet bubble or the lead up to the 2007 financial crisis, markets can get very inefficient. Collections of intelligent and diverse heterogeneous agents are capable of forming self-organizing, learning, adaptive collectives that can exhibit the “wisdom of crowds.” The method that some people have pursued to study the interaction of heterogeneous agents is known as agent-based modeling.

- “You don’t need something more to get something more. That’s what emergence means. Life can emerge from physics and chemistry plus a lot of accidents. The human mind can arise from neurobiology and a lot of accidents, the way the chemical bond arises from physics and certain accidents. Doesn’t diminish the importance of these subjects to know they follow from more fundamental things plus accidents.” “The particular details of the history that we experience we can learn only by looking around us.”

Mauboussin: “The second characteristic of complexity is that the agents interact with one another. That interaction leads to the third—something that scientists call emergence: In a very real way, the whole becomes greater than the sum of the parts.” To say something is “complex” is not the same as saying something is “complicated.” Wendell Jones explains the difference: “Complicated linear and determined systems produce controllable and predictable outcomes. Complex adaptive systems can produce novel, creative, and emergent outcomes.” An investor like Howard Marks makes his work consistent with this idea by focusing on microeconomics economics rather than macroeconomics. Microeconomics is orders of magnitude less complex and as a result is far less impacted by chaos and the flap of a butterfly’s wings. What you can do is focus on what you know best. We can know a fair amount about the present if we work and pay attention. We have zero information about the future.

8.“No gluing together of partial studies of a complex nonlinear system can give a good idea of the behavior of the whole.”

Mauboussin elaborates on the third element of complexity in this way: “The key issue is that you can’t really understand the whole system by simply looking at its individual parts. “You can’t make predictions in any but the broadest and vaguest terms.” Complex adaptive systems effectively obscure cause and effect.” “Complexity doesn’t lend itself to tidy mathematics in the way that some traditional, linear financial models do.” “Increasingly, professionals are forced to confront decisions related to complex systems, which are by their very nature nonlinear… ” A major implication of this point is that reductionist thinking and methods are not only useless but can lead to dangerous conclusions. It is not possible to make macro predictions by simply summing up micro empirical outcomes when complex systems are involved.

- “The word chaos is used in rather a vague sense by a lot of writers, but in physics it means a particular phenomenon, namely that in a nonlinear system the outcome is often indefinitely, arbitrarily sensitive to tiny changes in the initial condition.”

An MIT summary of Stuart Kauffman’s book entitled At Home in the Universe reads as follows: “chaos theory, concerns the “butterfly effect” in which “a legendary butterfly flapping its wings in Rio changes the weather in Chicago.” This point highlights the sensitivity of complex systems to miniscule changes in initial conditions. Taken together, these considerations preclude the possibility of predicting long-term behavior of such systems.” How does this inform investment decisions? Chaotic systems are not always complex, and complex systems are not always chaotic. It depends.

“two states that are very close together initially and that operate under the same simple rules will nevertheless follow very different trajectories over time. This sensitivity makes it difficult to predict the evolution of a system, as this requires the initial state of the system to be described with perfect accuracy.”

10. “Complex adaptive systems have the wonderful property of exploring new possibilities and trying out new possibilities and spawning new complex adaptive systems, and so on.”

I like to think about nests of complex adaptive systems. One complex system impacts others and spawns more complex systems and Evolution happens. Philip Nelson writes humorously: “At the dawn of the twentieth century, it was already clear that, chemically speaking, you and I are not much different from cans of soup. And yet we can do many complex and even fun things we do not usually see cans of soup doing.” Gell-Mann believes that this idea leads naturally to the conclusion that there are other forms of consciousness in the universe. Evolution on this planet reflects this same process. Ant colonies and immune systems are often used as an example to explain a complex how a system experiments and learns. Melanie Mitchell, the author of the book Complexity: A Guided Tour writes:

Both immune systems and ant colonies use randomness and probabilities in essential ways. The receptor shape of each individual lymphocyte has a randomly generated component, so as to allow coverage by the population of many possible pathogenic shapes. The spatial distribution of lymphocytes has a random component, due to the distribution of lymphocytes by the blood stream, so as to allow coverage of many possible spatial distributions of pathogens. The detailed thresholds for activation of lymphocytes, their actual division rates, and the mutations produced in the offspring all involve random or noisy aspects. Similarly, the movement of ant foragers has random components, and these foragers are attracted to pheromone trails in a probabilistic way. Ants also task-switch in a probabilistic manner. It appears that such intrinsic random and probabilistic elements are needed in order for a comparatively small population of simple components (ants or cells) to explore an enormously larger space of possibilities, particularly when the information to be gained is statistical in nature and there is little a priori knowledge about what will be encountered.

- “Anyone having a creative idea even in everyday life has to shake up the usual patterns in some way to get out of the rut (or the basis of attraction)of conventional thinking, dispense with certain accepted but wrong notions and find a new and better way to formulate some problem. [The stages of creativity are] actually very well-known:

a) Saturation-you fill yourself full of the contradiction between the problem you need to work on and the existing idea that’s somehow not good enough, or the existing method that is somehow not good enough to deal with the problem.

b) Incubation- After you’ve confronted this contradiction between what’s available and what’s needed, for a long time, apparently further conscious thought is no good anymore. And at that point, some sort of mental process out of awareness seems to take over, I guess what the shrinks would call the pre-conscious. It starts to cook this material.

c) Illumination- One day, while cooking or shaving or cycling, by a slip of the tongue or even while sleeping and dreaming, according to certain people, an idea suddenly comes.

d) Verification- And maybe the idea is right. See if it’s a good idea.”

Rob Goodman, who co-authored a book about Claude Shannon, made this comment about his creativity on Reddit:

I don’t mean to suggest that Shannon was lazy–like lots of remarkably successful people, he had his bouts of intense and concentrated activity. This was especially true in his younger years–we discuss some accounts from an acquaintance of his at the time he was working on his information theory paper, who says that Shannon would compulsively scribble ideas on napkins, or stare into space in deep concentration, or mention getting up in the middle of the night to work when struck by an idea. So when Shannon was in the midst of one of his highly creative periods, he certainly had a capacity for work to match anyone.

But what really distinguished Shannon was that he didn’t try to force it. We called our book A Mind at Play because we think that captures Shannon so well. He asked silly questions, loved tinkering in his workshop, and was often seen unicycling down the hallways of Bell Labs. He had a folder of “Letters I’ve Procrastinated on for Too Long.” And he approached his work in just the same spirit–we called it “play of the adult kind,” or play with ideas and concepts.

In other words, the main lesson we take from Shannon’s life in this regard is that the people who are most productive on the scale the matters–like, world-changingly productive–don’t worry about being productive every single hour. They can work intensely when they need to, but they also know how much is to be gained from letting the mind wander.

As an example, my friend Craig McCaw is like Shannon in the way he approaches life which enhances his creativity. I loved it when I got a message from him that he wanted me to fly with him in his vintage Beaver seaplane to have lunch somewhere in the middle of a business day. Flying or boating makes him happy and sparks his creativity. Some play combined with hard work makes him a more creative and therefore results in better business decisions. An entire company of people like Craig would not work well but a few people like him makes it stronger and more profitable.

12. “If someone says that he can think or talk about quantum physics without becoming dizzy, that shows only that he has not understood anything whatever about it.”

When I first read the sentence in bold immediately above I remember thinking to myself: If quantum physics makes Gell-Mann dizzy, what hope do I have of understanding it? It also made me think about an essay written by Michael Citchton that is related to Gell-Mann:

Media carries with it a credibility that is totally undeserved. You have all experienced this, in what I call the Murray Gell-Mann Amnesia effect. (I call it by this name because I once discussed it with Murray Gell-Mann, and by dropping a famous name I imply greater importance to myself, and to the effect, than it would otherwise have.) Briefly stated, the Gell-Mann Amnesia effect works as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward-reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them. In any case, you read with exasperation or amusement the multiple errors in a story-and then turn the page to national or international affairs, and read with renewed interest as if the rest of the newspaper was somehow more accurate about far-off Palestine than it was about the story you just read. You turn the page, and forget what you know. That is the Gell-Mann Amnesia effect. I’d point out it does not operate in other arenas of life. In ordinary life, if somebody consistently exaggerates or lies to you, you soon discount everything they say. In court, there is the legal doctrine of falsus in uno, falsus in omnibus, which means untruthful in one part, untruthful in all. But when it comes to the media, we believe against evidence that it is probably worth our time to read other parts of the paper. When, in fact, it almost certainly isn’t. The only possible explanation for our behavior is amnesia.

Imagine what Gell-Man must think when reading someone else’s article on quantum mechanics. I am reminded of the scene from the 1977 movie Annie Hall when the character played by Woody Allen is able to make the media philosopher Marshall McLuhan appear to correct the view of someone who is pontificating in the movie line. McLuhan tells the man: “I heard what you were saying. You know nothing of my work.”

Gell-Mann is often not satisfied even by the way he writes about his ideas. His perfectionism is legendary, illustrated by his struggles to write his book The Quark and the Jaguar, as described in the New York Times:

Uneasy with any work that isn’t world-class perfect, Gell-Mann for years found writing excruciating, and the book was no exception. His agent thought a ghost writer would help. Gell-Mann plowed through three. One, who had helped produce the 32-page proposal that sold the book, bowed out after that point and wrote his own book; the next one simply couldn’t bear the flaws Gell-Mann would find in everything he wrote and dropped out; a third wisely decided his three-month job was only to edit and encourage as Gell-Mann agonized over his own hen-scratchings. The chapters Gell-Mann finally delivered were written by no one but himself. By then, having fallen far behind schedule, Gell-Mann was dropped by his first publisher; he found a second one, but nearly exhausted its patience with his last-minute corrections.

P.s., Here is an interesting paper from 2016 that many readers may not be aware of that Gell-Mann co-wrote entitled: “Exploring Gambles Reveals Foundational Difficulty Behind Economic Theory (and a Solution!).” In a press release announcing the paper Gell-Mann is quoted as follows:

…the following perspective arose: to assess some uncertain venture, ask yourself how it will affect you in one world only — namely the one in which you live — across time,” Gell-Mann continued. “The first perspective — considering all parallel worlds — is the one adopted by mainstream economics,” explained Gell-Mann. “The second perspective — what happens in our world across time — is the one we explore and that hasn’t been fully appreciated in economics so far.” https://publishing.aip.org/publishing/journal-highlights/exploring-gambles-reveals-foundational-difficulty-behind-economic

Notes:

http://calteches.library.caltech.edu/2766/1/gellmann.pdf

http://almaz.com/nobel/physics/1969a.html

http://larvatus.com/michael-crichton-why-speculate/

http://www.nytimes.com/books/99/10/17/reviews/991017.17bloomft.html?mcubz=1

https://sites.hks.harvard.edu/fs/rzeckhau/unknown_unknowable_PUP.pdf

http://evonomics.com/radical-remaking-of-economics-eric-beinhocker/

http://complexity.martinsewell.com/Gell95.pdf

http://www.williamjames.com/transcripts/gell1.htm

http://billmoyers.com/content/murray-gell-mann-quarks/

https://web.archive.org/web/20050215150025/http://physicsweb.org/articles/world/16/6/2/1

http://www.abcnewsgo.net/video/y3fSB6ut-cT0

https://www.edge.org/conversation/murray_gell_mann-the-making-of-a-physicist

http://web.mit.edu/esd.83/www/notebook/ComplexityKD.PDF

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2465602/

https://www.pehub.com/vc-journal/picking-winners-is-a-myth-but-the-power-law-is-not/

- A Dozen Lessons about Business and Life from Jimmy Iovine

- A Half Dozen Lessons About Writing and Getting a Book Published

Categories: Uncategorized