The economist Robert Gordon is the author of a book entitled “The Rise and Fall of American Growth.” I have yet to read a review that does not like most of Gordon’s book. For example, Bill Gates writes in his review of the book https://www.gatesnotes.com/Books/The-Rise-and-Fall-of-American-Growth: “Gordon does a phenomenal job illustrating just how different life was in 1870 than it was in 1970, through both an economic analysis and engaging narrative descriptions. Most reviews have focused on the “fall” indicated in the title: the last hundred pages or so, in which Gordon predicts that the future won’t live up to the past in terms of economic growth. I strongly disagree with him on that point.” I agree with Gates’ review of the book so I won’t write my own review and will instead focus the argument made by Gordon that Gates refers to toward the end of the book. I have had a hard time writing a blog post since I want to be respectful of Gordon and his work but disagree with him on this point. I don’t recall rewriting a post as many times as I have this one. While it has not been easy to write I feel compelled to do so since I believe that failure to understand why this alleged innovation plateau may result in serious policy and other mistakes.

The strangest thing about Gordon’s assertion about an innovation plateau starting in 1971 is identified by Diane Coyle. In her review of Gordon’s book she writes: “Throughout the first two parts of the book, Gordon repeatedly explains why it is not possible to evaluate the impact of inventions through the GDP and price statistics, and therefore through the total factor productivity figures based on them.” What Coyle is pointing out is that the early pages of Gordon’s book include statements like: “This book … focuses on the aspects of improvements of human life that are missing from GDP altogether.” Despite the problems with GDP and price statistics identified on the book, Gordon uses these metrics to conclude that “there are just so many dimensions of human life where we seem to have reached a plateau in innovation.” Gordon’s pessimism about the impact of innovation is typified by the dreary title of his paper: “US Economic Growth is Over.” When it comes to the impact of innovation on productivity and human welfare going forward, Gordon’s views on the impact of innovation make Eeyore seem positively cheerful.

Gordon relies heavily on the assertions and concepts described below in making his argument that the impact of innovation has plateaued:

“Our best measure of the pace of innovation and technical progress is total factor productivity (hereafter TFP), a measure of how quickly output is growing relative to the growth of labor and capital inputs.”

“Growth in total factor productivity (the metric that captures innovation) was much faster between 1920 and 1970 than either before 1920 or since 1970. From 1970–1994, it was only 0.57 percent a year, less than a third the 1.89 percent rate of 1920-1970. Total factor productivity growth, or TFP, was notably faster from 1994–2004 than in other post-1970 intervals, but that brief revival was an aberration: It was much shorter lived and smaller in magnitude.”

Gordon’s reliance on the TFP to reach his conclusion about the impact of innovation concept is unfortunate. Bill Gates explains the TFP concept and its problems in a way that is easy for anyone to understand:

“As Gordon acknowledges many times, we don’t have a good tool for measuring the impact of innovation on people’s lives. Like other economists, Gordon uses something called Total Factor Productivity (TFP), which is meant to capture efficiency due to innovation. TFP is based on GDP but takes into account the hours we work and the equipment we use. The truth is, while economic measurements like TFP can be useful for understanding the impact of a tractor or a refrigerator, they are much less useful for understanding the impact of Wikipedia or Airbnb. GDP may not grow as fast as it did in the past, but that alone doesn’t tell you whether people’s lives are going to get better. How do you calculate the value of millions of pages of free information at your fingertips? How do you calculate the impact of the entire hospitality industry flipped on its head?” https://www.gatesnotes.com/Books/The-Rise-and-Fall-of-American-Growth

University of California at Berkeley economist Bradford DeLong expands on the same point made by Gates:

“Northwestern University economist Robert J. Gordon maintains that all of the true “game-changing” innovations that have fueled past economic growth – electric power, flight, modern sanitation, and so forth – have already been exhausted, and that we should not expect growth to continue indefinitely. But Gordon is almost surely wrong: game-changing inventions fundamentally transform or redefine lived experience, which means that they often fall outside the scope of conventional measurements of economic growth. If anything, we should expect to see only more game changers, given the current pace of innovation. Measures of productivity growth or technology’s added value include only market-based production and consumption. But one’s material wealth is not synonymous with one’s true wealth, which is to say, one’s freedom and ability to lead a fulfilling life. Much of our true wealth is constituted within the household, where we can combine non-market temporal, informational, and social inputs with market goods and services to accomplish various ends of our own choosing. While standard measures show productivity growth falling, all other indicators suggest that true productivity growth is leaping ahead, owing to synergies between market goods and services and emerging information and communication technologies.” https://www.project-syndicate.org/commentary/economic-trends-productivity-growth-inequality-by-j–bradford-delong-2016-11

Another reason why TFP is not a good measure of the impact of innovation is that it is based on GDP which is also flawed. The Economist magazine has written a helpful survey of the problems with the GDP concept, including (1) a bias for activities that involve manufacturing (which is declining as a share of the economy) and (2) measuring only what is bought and sold. The Economist’s survey also points out that the nature of output has rapidly changed in ways that make the GDP concept less useful:

“It is not just that many new services are now given away free; so are some that used to be paid for, such as long-distance phone calls. Some physical products have become digital services, the value of which is harder to track. It seems likely, for instance, that more recorded music is being listened to than ever before, but music-industry revenue has shrunk by a third from its peak. Consumers once bought newspapers and maps. They paid middlemen to book them holidays. Now they do much more themselves, an effort which doesn’t show up in GDP. As commerce goes online, less is spent on bricks-and-mortar shops, which again means less GDP. Just as rebuilding after an earthquake (which boosts GDP) does not make people wealthier than they were before, building fewer shops does not make them poorer.”

Making these metrics even less useful is the fact that TFP is based on other flawed assumptions, such as assuming that there are no returns to scale in an economy and that the economy reflects a state of perfect competition. The economics of software in particular are driven by returns to scale, and as the impact of software grows over time that makes TFP even more inaccurate.

You may be thinking: Gordon has written a really long book, surely it must contain data that supports his claim that the impact of innovation has plateaued. The answer to this question is: no. It is true that TFP is not climbing like it once did but as has been previously explained TFP is very flawed as a measure of innovation’s impact (as is the GDP metric it is based on). Are there easy to understand metrics that can easily replace TFP and GDP? Not really. But that does not mean making policy decisions based on TFP makes any sense. Relying on TFP to gauge the impact of innovation is like using a pickle to change a car tire. It may be fun for people with mathematical gifts to calculate TFP, but eating a pickle is also fun.

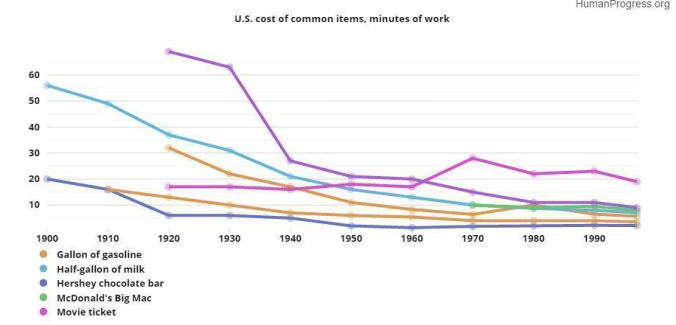

What about data to support the “innovation has not reached a plateau” story? Well, we can look at a range of trends that show that actual human welfare based on things we can actually measure did not stop having significant impact starting in 1971. Measuring real impact is superior to a broken formulas based on fake assumptions. For example, in the real world there is the example of the falling price of solar power:

There are many other metrics as well that refute the idea that there was innovation impact plateau starting in 1971. You can see more data supporting my view at the end of this post. The TFP formula utterly fails the “does the result map to reality” test.

Understanding why Gordon feels the way he does about the impact of innovation is put into context by looking a few of his public statements on technology and innovation:

“Everywhere I go, I see technology doing almost exactly what it was doing 10 years ago. Receptionists sitting in front of flat screens, making appointments, just identical to what was happening 10 years ago.”

“When you check out in the supermarket, you have bar-code scanning, and you have instant credit card authorization. When you get money, you get it out of the cash machine, which is a form of robot that makes it unnecessary to walk inside a bank.”

“The entire decade of the rollout of the smartphone and all the applications have not caused productivity growth to budge.” http://www.cnsnews.com/news/article/no-smartphones-arent-innovative-why-pay-lagging

“This book was written the old-fashioned way. It was written with stacks of books taken out of the library. The only modern invention that was involved in writing this book, besides the word processor, was Post-Its stuffed in the books to flag important passages. There was very little reliance on the Internet in the writing of the book.” http://www.northwestgeorgianews.com/associated_press/business/state_national/no-smartphones-aren-t-that-innovative-why-pay-is-lagging/article_18bd0f90-dbf4-11e5-bf48-274655b20bc8.html

To say that I disagree with everything Gordon said above is a huge understatement. Few receptionists today just “make appointments” and many receptionist jobs have been eliminated by automation. Supermarkets use very different technology today and are far more productive that their predecessors, especially the new one created by Amazon that will have no checkers or self-serve check out process. In this Amazon store:

“you scan in with an app on your phone as you walk into the store, grab whatever you want — and leave. “Computer vision,” “deep learning algorithms” and “sensor fusion” figure out what you’ve taken and charge you for it. http://www.wvgazettemail.com/gazette-op-ed-commentaries/20161210/justin-fox-when-the-store-checkout-lines-go-away#sthash.NXFlPlbn.dpuf

Anyone who has visited a developing country knows how smartphones have boosted productivity in a huge way, let alone what they have done in the US. I use the Internet extensively for example in writing and researching and often on my smartphone. Having GPS functionality built into a supercomputer in your pocket did not exist 78 years ago when Gordon was born nor did it exist in 1971 that year Gordon says technology plateaued. I will say that there is less smartphone use and technology use in general in people above the age of 75, but that is a small slice of total users with usage that does not reflect usage of other age groups:

The absence of accurate metrics about the impact of innovation means that people are going to tell stories about that topic. Someone like Gordon who makes “good old days” statements about innovation’s impact from the past being better that inventions since 1970 is going to tell a different sort of story about the impact of technology than someone like me. The good old days crowd might make an argument like Gordon does here:

Gordon “flashes a photo of a smartphone and a toilet on a screen and asks his audience what they would do if they had only two options: Keep everything invented up until 2002, or keep everything invented up until today—but give up running water and toilets. The answer to him is obvious: Indoor plumbing changed how people live, he says, smartphones are just a handier form of what already exists.” http://blogs.wsj.com/economics/2014/06/15/if-you-had-to-choose-iphone-or-toilet/

Gordon is telling a story based on anecdotes which reflects his view that the “Great Inventions” from the past can’t be replicated. Part of this story includes a claim that nothing happening today compares to ending diseases like polio during the pre-1971 period. My view is that this story is the result of the same “availability bias” that makes people fear shark attacks or believe that plane crashes kill more people than auto accidents. Innovation today is far more distributed and effects many more people. Thomas Edison working as a lone inventor in his lab is not how innovation happens in today’s economy. The more credible alternative story to Gordon’s is that the collective value of innovation today from technologies like falling solar prices, personal computers, mobile phones, mobile apps or modern medical advances like CRISPR are bigger not smaller than in the pre-1971 period. Cars from three different companies are driving around San Francisco without drivers right now. You can say well that is destroying jobs. We can argue about that. But you can’t say that innovation’s impact plateaued in 1971 and at the same time say automation is increasingly eliminating jobs. Select any one argument but not both.

When Gordon claims that what is being created as innovation today are just incremental improvements on what came before 1971, Gordon is essentially making an argument that is similar to someone arguing that electric lighting is just an improvement on a campfire or that a modern automobile is just an improvement on a horse. That human needs are often persistent does not mean that the impact of innovation plateaued starting in 1971.

A far more plausible story than Gordon’s about what happened to TFP and GDP after 1971 is: (1) the economy has shifted rapidly from manufacturing to services; and (2) more of the benefits of innovation are consumer surplus (i.e., not something producers can monetize). These two developments and others mean innovations is increasingly poorly measured in both GDP and TFP. The fundamental nature of the output of the economy, consumption and welfare has changed and will continue to change. You may call my explanation a story too, but it is a far more plausible story than Gordon’s to anyone paying attention to the advance of technology today and the ways in which the economy is changing. Is academia struggling to increase productivity? Sure. Baumol’s cost disease is a significant problem for academia. But just about anyone involved in business on a daily basis knows that innovation’s impact is increasing rapidly. Innovation in business today is relentless. Ask Motorola or Nortel or HTC or Blackberry.

In telling my story I’m not going to explain in detail what consumer surplus is (since most of you will stop reading) other than to say that is calculated by analyzing the difference between what consumers are willing to pay for a good or service relative to its market price. Roughly: “Total economic welfare = consumer surplus + producer surplus.” The measurement problem with consumer surplus comes from that fact that it is not possible to estimate the shape of demand for products when there is no measurable price. For example, what is the consumer surplus from WhatsApp or Wikipedia which has a price of zero? If you ask this question about WhatsApp to someone arguing that the impact of innovation has plateaued, they inevitably change the subject.

Brad DeLong describes why a software-driven economy is fundamentally different:

The key difference is between “Smithian” commodities–where it is a safe rule of thumb that the consumer surplus generated is about equal to the producer cost, so that GDP accounts that value goods and services at real producer cost will capture a more-or-less stable fraction equal to half of true standards of living–and… I might as well call them “Andreesenian” commodities, where consumer surplus is a much larger proportion of monetized value because what is monetized is merely an ancillary good or service to what actually promotes societal welfare. What is the proportion? 5-1? 10-1? Somewhere in that range, I think–at least. http://delong.typepad.com/sdj/2015/01/afternoon-must-read-tim-worstall-facebook-explains-why-marc-andreessen-and-larry-summers-disagree.html

DeLong wrote that pointing to an article by Tim Worstall. In that article Worstall wrote: “the gap between ‘real living standards’ and “recorded living standards” is growing simply because so much more of the value of the new technologies is not in fact monetized.” Worstall explains:

“‘consumer surplus’ is the value that we consumers derive from whatever it is over and above the price we’ve got to pay to get it. A general assumption is that we derive a consumer surplus from absolutely everything that we do buy: if we didn’t gain more value than it cost us then we wouldn’t buy it, would we? Brad Delong once pointed out (or perhaps pointed to someone who pointed out) that one way of looking at rising living standards in the 20th century was a factor of about 8. Rich world people in 2000 were 8 times better off than rich world people in 1900. Roughly true by those standard measures of GDP and so on. But if we than added what people could do, the improvements in quality, all something analagous to that consumer surplus. it might be more true to say that people were 100 times better off. That’s how I would explain (some of) that productivity puzzle. A larger than normal portion of the output of the new technologies is not monetised so we’re just not counting it as output at all.”

That the level of consumer surplus is hard to quantify does not mean that economists don’t try to do so. The economist William Nordhaus writes:

“We conclude that only a minuscule fraction of the social returns from technological advances over the 1948-2001 period was captured by producers, indicating that most of the benefits of technological change are passed on to consumers rather than captured by producers.” http://www.nber.org/papers/w10433

Nordhaus estimates that an innovator’s ability to capture the benefits of their innovation is in the low single digits and that the benefits that consumer’s get can be 25-50 times higher than the innovator. Why? The Economist magazine explains:

“Nordhaus, an economist at Yale University, looked at two ways of measuring the price of light over the past two centuries. You could do it the way someone calculating GDP would do: by adding up the change over time in the prices of the things people bought to make light. On this basis, he reckoned, the price of light rose by a factor of between three and five between 1800 and 1992. But each innovation in lighting, from candles to tungsten light bulbs, was far more efficient than the last. If you measured the price of light in the way a cost-conscious physicist might, in cents per lumen-hour, it plummeted more than a hundredfold.”

Do I believe the calculations of Nordhaus on consumer surplus are precisely accurate, especially when he calculates a figure to the right of the decimal point? Certainly not. But I do believe Nordhaus is at least directionally correct.

Today’s technology advances are often producing efficiency improvements which in turn produce lower costs, which translates into lower spending and measured GDP even though actual GDP is higher. For example, the percentage of firms reporting what is effectively zero inventory levels has increased to more than 20% from less than 5%. This reduction in inventory levels is unprecedented. More is being done with less and yet traditional measurements say that productivity is decreasing since less money is being spent. The key to understanding this change and how it confounds traditional approaches to measuring progress is made clear by example: If an economy doubles output, but competition halves the price, GDP is unchanged but real productivity has doubled.

Another major reason why many people underestimate the impact of innovation is that most innovation has no moat! Many people assume that innovation always creates more producer surplus and profit. The equate the wealth of a few exceptional innovators with what is happening as a whole (availability bias). Charlie Munger describes the reality for any business person best:

“The great lesson in microeconomics is to discriminate between when technology is going to help you and when it’s going to kill you. And most people do not get this straight in their heads. There are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.”

The point Munger just made so clearly is counter-intuitive for many people, but essential to understand. Moat creation is incredibly hard and rare. It is a massive mistake to confuse a moat shortage with an “impactful” innovation shortage. Some innovation does not produce any profit and in fact can destroy profit. For every firm creating disruption some other firms are being disrupted. Munger is saying that sometimes both the disrupting businesses and the disrupted businesses generate only losses from an innovation and consumers are the only beneficiaries. Moat creation is so hard that Munger and Buffett don’t even try to create moats and instead focus on buying them. Other people do try to create new moats and that is essential for the economy. Most venture capital investments fail but a few succeed spectacularly enough to make the investment system very profitable for some venture capitalists and highly beneficial for society. Lots of failure is essential for capitalism to work properly since it is experimentation based on trial and error that drives innovation.

If you are feeling confused at the state of the world as you read this in 2016 it is because your brain is operating normally. Charlie Munger makes that point below in the context of monetary policy, but he just as easily could have been referring to how technology is changing the world:

“I think something so strange and so important [as current central bank policies] is likely to have consequences. I think it’s highly likely that the people who confidently think they know the consequences – none of whom predicted this – now they know what’s going to happen next? Again, the witch doctors. You ask me what’s going to happen? Hell, I don’t know what’s going to happen. I regard it all as very weird. If interest rates go to zero and all the governments in the world print money like crazy and prices go down – of course I’m confused. Anybody who is intelligent who is not confused doesn’t understand the situation very well. If you find it puzzling, your brain is working correctly.” http://www.forbes.com/sites/phildemuth/2015/04/20/charlie-mungers-2015-daily-journal-annual-meeting-part-3/#434e750f6f0e

Why is the period since 1970 such a confusing time? If Gordon gets to tell a story, people like me should get to tell our story too, especially since ours is a lot more credible. My story begins when Intel began selling the 4004 semiconductor in 1971, the exact same year that Gordon claims innovation plateaued.

This semiconductor and others that followed famously caused Bill Gates to dropped out of Harvard and start Microsoft with Paul Allen. They moved to Albuquerque to write software for the Altair computer they first saw in a Popular Electronics magazine at a newsstand in Harvard Square. The price of the computer in 1975 was $397. It was primitive and lacked easy-to-use software, but even then they could see the potential for this device since they experienced how valuable having access to a computer could be. Despite their youth, especially in the context of how business was conducted at that time, Gates and Allen realized that if their business was not formed immediately they would miss the opportunity. They also realized that what the hardware enabled and where the bulk of the value would accrue was software. Gates recalls: “When we saw [the Altair], panic set in. ‘Oh no! It’s happening without us! People are going to write real software for this chip!’” Gates captured the key factor in driving the rise of software as a driver of business value many years later in a famous 1994 interview with Playboy magazine: “When you have the microprocessor doubling in power every two years, in a sense you can think of computer power as almost free. So you ask: Why be in the business of making something that’s almost free? What is the scarce resource? What is it that limits being able to get value out of that infinite computing power? Software.” He has also pointed out that “software is so inexpensive to duplicate that substituting it for costly hardware reduces system costs. At Microsoft, our only ‘hammer’ is software…. It’s all about scale economics and market share. You can afford to spend $300 million a year improving it and still sell it at a low price.” That productivity statistics started changing in 1971 the year the 4004 chips appeared is not a coincidence.

This point made by Gates is critical to understanding the unique economics of software. Also important is that the dollars spent creating the software are what an accountant calls “sunk.” Ben Thompson writes: “What makes the software market so fascinating from an economic perspective is that the marginal cost of software is $0. After all, software is simply bits on a drive, replicated at the blink of an eye. Again, it doesn’t matter how much effort was needed to create said software; that’s a sunk cost. All that matters is how much it costs to make one more copy: $0. The implication for apps is clear: any undifferentiated software product, such as your garden variety app, will inevitably be free. This is why the market for paid apps has largely evaporated. Over time substitutes have entered the market at ever lower prices, ultimately landing at their marginal cost of production: $0.” Software has unique economics since it is a public good and that creates new challenges for the economy.

All businesses and occupations are being impacted by the software revolution. The phrase “software business” is now as redundant as the term “technology business.” Every business is being impacted by technology, most importantly software. This transformation is not a completely new phenomenon, but the pace of change is. John Naughton has pointed out: “In 1999, Andy Grove, then the CEO of Intel, was widely ridiculed for declaring that ‘in five years’ time there won’t be any internet companies. All companies will be internet companies or they will be dead.’ What he meant was that anybody who aspired to be in business in 2004 would have to deal with the internet in one way or another, just as they relied on electricity. And he was right.” What is different a decade later is that the pace of change driven by this software revolution has accelerated because the change is happening on multiple dimensions that feed back on each other. As just one example, the speed at which the operations of business are moving to the cloud and the implications of that one change alone are staggering.

The 4004 chip was the first of many products sold by chipmakers that unleashed exponential change. Since few aspects of life are exponential when humans do have such an experience it almost seems like magic, especially at first. People are simply not good at understanding exponential change. Bill Gates once put it this way: “When things are improving so rapidly, how do you create a model in your head? Computers are doubling in power, relative to the price, about every 18 months. Most humans don’t have a situation where something doubles in power that fast.” Except for a virus or bacteria increasing in number inside your body, few things in a human’s life are nonlinear.

These are confusing times, but that is no reason to adopt a pessimistic outlook on the potential of innovation to create enormously beneficial impacts. There is no question that today’s economy and the technological changes that power the economy have created a significant number of new problems that we must solve. We must discover new solutions to these new problems and this will require innovations of many kinds. Economic growth is far from “over.” The impact of innovation has not plateaued.

P.s., More support for my view is set out below. There are too many other example to mention here, but this is a start:

- Why is Customer Acquisition Cost (CAC) like a Belly Button?

- What You Can Learn about Business from a Dozen Lines in the Godfather

Categories: Uncategorized