Reed Hastings is the Chairman, CEO, President and co-Founder of Netflix. After graduating from Bowdoin College in Maine Hastings joined the Peace Corps. He then obtained a master’s degree in computer science at Stanford. Hastings was the founder of Pure Software which built tools for Unix software developers. Pure was acquired by Rational Software in 1997, the same year Netflix was founded.

- “We’re figuring out every year how to use the Internet to make a great consumer experience. Every year is an experiment.” “We are investing heavily in [machine learning] because we want it to be: you turn on Netflix and there’s a row, there’s like four choices, and you just want to watch them all. To get to that consistent view is where we are targeting.” “We’re very experimental so if it works well we’ll do more. If it doesn’t work well, you won’t hear about it anymore.” “Netflix ‘gets me’ is the emotion we are looking for.” “If the Starbucks secret is a smile when you get your latte, ours is that the Web site adapts to the individual’s taste.” “We are just a learning machine. Every time we put out a new show we are analyzing it, figuring out what worked and what didn’t so we get better next time.” “It’s not Netflix that’s making the changes. It’s the Internet.

Netflix is a leading example of a business which understands the power of a connected and data-driven relationship with a customer. This relationship creates a powerful platform that enables a business to constantly experiment to discover, among other things, how to: (1) deliver more value to customers; (2) expand the market for existing products and services and create new products and services and (3) help customers find what will make them happiest. The goal with this process is to drive the best indicator of customer happiness which is actual usage of the product or service. As just one data point on how powerful this approach can be: more than 80% of the video people watch on Netflix is discovered through a recommendation engine. Wired describes the process:

Netflix uses machine learning and algorithms to help break viewers’ preconceived notions and find shows that they might not have initially chosen. To help understand, consider a three-legged stool. “The three legs of this stool would be: Netflix members; taggers who understand everything about the content; and our machine learning algorithms that take all of the data and put things together,” says Todd Yellin, Netflix’s vice president of product innovation.

People tend to put a lot of emphasis on Netflix using machine learning to decide what video content to create and not enough emphasis on how it is used to more efficiently acquire customers and turn them into fans of its services. The use of machine learning to improve customer acquisition and marketing has resulted in significant improvements in customer unit economics in many industries but Netflix is one of the best examples. For example, huge investments are now being made by businesses in systems which optimize every type and aspect of acquisition funnels. If one business does not use machine learning in this way and its competitors do so, that business is operating with a huge possibly fatal disadvantage. To illustrate how machine learning can be used to improve marketing, after making the initial decision to invest in House of Cards the most important use of machine learning by Netflix was to optimize marketing and distribution rather than production. By using machine learning approaches is it possible through experimentation to find the optimal approach to creating “fans” for Netflix’s services. Modern technology enables mass customization so that the nature of the trailer each person sees and when the video is released for viewing to be optimized to create the desired word of mouth.

Once a connected relationship exists with customers the ability of the service provider to use telemetry data respond to customer desires and behavior is greatly enhanced. Systems can be created to run experiments at lower cost and greater speed than has ever been possible before due to the proliferation of a vast array of cloud-based services. Once the experimentation process is automated, people like marketers, product managers and engineers have the ability to run experiments quickly without the direct involvement of a data scientist. The speed at which optimizing product and service experiments can be run provides a business with either a significant competitive advantage or the ability of that business to stay in business if competitors are doing so. As Charlie Munger says:

“The great lesson in microeconomics is to discriminate between when technology [like machine learning] is going to help you and when it’s going to kill you. And most people do not get this straight in their heads…. that there are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements [in a technology like machine learning] are going to flow through to the customers.”

Can a business opt out of making machine learning investments? Well, it can’t do so for very long and stay in business.

The biggest cultural change that businesses are going through as a result of this technological shift is a transition from being organizations that measured themselves by shipping products and services to organizations driven by actual customer usage of services. I heard someone say recently that “everyone needs to become a data scientist” and I like that phrase a lot. Of course, systems and tools must be created to make this “we are all data scientists now” more of a reality. Creating these systems is essential since the alternative of employees of a business getting in line to wait for their turn to talk to a “real data scientist” will not scale.

Hastings does not talk about how research is used at Netflix to supplement data science, but I suspect that the emphasis on data about actual usage does not mean that they don’t conduct any research. For example, with a new product or service there is not yet any use to measure, so research can be valuable. Some blending of quantitative and qualitative data is probably happening at Netflix. This text from an article in The Guardian describes one aspect of decision making at Netflix that makes clear that human intuition is still a big part of how they make decisions:

Ted Sarandos once called himself a “human algorithm” because of his use of data rather than gut instinct to work out what viewers want, and he has described House of Cards as “generated by algorithm”: … he used data to work out how many subscribers loved both political thrillers and Kevin Spacey. “Big data is a very important resource to allow us to see how much to invest in a project but we don’t try to reverse-engineer,” he says, adding that commissioning decisions are more like “70% science and 30% art”.

What sort of data do they look at?

“…the focus is on the audience, and that there is no programming grid – or appointment linear-based television – that is typically used by traditional TV networks. Barometers of success are if the audience completes watching the show, the timeframe within which they finish watching a series if there is social media buzz by critics and fans.”

2. “What we do is try to learn and adapt. Rather than commit to one particular point of view, we will adapt.”

The truism is: the only constant is change. What is different about this truism now is that the pace of change is accelerating. When I hear people talk about a “Great Stagnation” I think: “What planet are these people living on?” and “What industry are they working in?” Developments in machine learning mean that systems can be created which allow adaptation to occur on a scale and at a speed never before possible. Prediction becomes less possible than ever (if it ever was possible) in this new environment due to rising complexity caused by connects systems and the ability to adapt quickly is vastly more important. Michael Mauboussin describes the challenge in this way: “Increasingly, professionals are forced to confront decisions related to complex systems, which are by their very nature nonlinear… Complex adaptive systems effectively obscure cause and effect. You can’t make predictions in any but the broadest and vaguest terms. … complexity doesn’t lend itself to tidy mathematics in the way that some traditional, linear financial models do.” A business like Netflix that has decided to focus on adaption and making decisions opportunistically at every step is trying to maximize optionality which allows them to handle complexity more effectively than their competitors. Nassim Taleb identifies the problem with a non-adaptive approach: “A rigid business plan gets one locked into a preset invariant policy, like a highway without exits —hence devoid of optionality.” The accelerating pace of change is creating a need for businesses to adapt faster and more efficiently. As Darwin famously said: ‘It is not the most intellectual of the species that survives; it is not the strongest that survives; the species that survives is the one that is able to adapt to and to adjust best to the changing environment in which it finds itself.”

3. “By 2011 we realized that many of the firms we were buying from were eventually going to want to run their own streaming service. We had no reliable supply. We had to go vertical since it was not going to be in their interest to sell to us over time.”

Hastings is saying that Netflix understands the dangers associated with “wholesale transfer pricing.” Eugene Wei has written specifically about how the concept applies to Netflix:

“Netflix had a great advantage when First Sale Doctrine permitted them to buy DVDs at the same wholesale price as any retailer since it capped their costs. But in the TV/movie licensing world, the content owner can constantly adjust their price to squeeze almost every last drop of margin from the distributor as you can’t find perfect substitutes for the goods being offered. Ask TV networks if they make any money licensing NFL, NBA, and MLB games for broadcast. Hint: the answer is no. In the digital world, transfer pricing can be even more of a cruel mistress.”

To illustrate what Netflix is trying to avoid with an analogy, imagine yourself walking into a store and wanting to buy an antique chest. Also assume that the owner by listening to what you said to your friend heard you say: “I simply must own it.” The merchant’s power to set the price combined with your desire to buy that chest means that you are in deep trouble in setting the price of the chest. Walking into that antique store and not needing to buy anything completely changes the negotiating dynamic on price. As a reminder:

- Don’t fight a land war in Asia;

- Don’t play cards with a man called Doc;

- Don’t write really long blog posts and expect many people to read to the end; and

- Don’t negotiate the price of something the seller knows you must have.

Netflix knows it must own a significant portion of its own content. It was forced to make a “burn the lifeboats” decision to move forward with owning content once they started streaming. The conventional wisdom was that tech companies which start dealing with Hollywood are inevitably eaten alive. And yet Netflix has made it work. But there were doubters at first. I remember when:

Hastings has made clear his view that a business can’t dabble in something like creating content or technology. He has said that at least one third of a company’s total resources must be committed in order for a business to have any financial success. He has also said that licensing content and trying to create a business around that is hard. Anyone and their dog can license and resell content to stream. Hastings believes: “It is easy to get into the streaming business– what is hard is making a profit.” Hastings tried licensing a few movies at Sundance and showing them on Netflix, but notes: “You can do the ‘money ball’ analysis about the content to figure how much it is going to get viewed. It is easy to see that it does not work.” Netflix had no choice but to start green lighting its own first party content “all in.” Business which dabble in something are setting themselves up for failure. Hasting’s view is that a business must jump in with both feet to be successful.

- “There are scale economies in companies like Netflix. Those merit investing forward to get to scale. Call that normal business. Then there are rare businesses like LinkedIn and Facebook where there are network effects. The power of getting to scale is so great, and they are such extreme winner-take-all markets, that it’s worth doing anything to scale. You do crazy things because you have to grow 300% to maximize the opportunity. You do things that are sloppy. If you’re in a network effect business, you get more of ‘first is forever.’” “Netflix is trying to combine personalization, on demand content, smart TVs and all these great geeky things with incredible content. If we can combine them better that protects us against HBO that is very good a content but not so good at tech.” “You know often the right strategy for a challenger brand which is Amazon in the case of streaming video is to try many things, because they’re not sure, just copying Netflix is not going to typically get someone very far. The leader’s role is to keep the main thing the main thing. Our focus is on doing even better content, getting better partnerships, better mobile streaming. We just have to have the discipline to keep doing what we’re doing at many times the scale, and if we do that, things will work out really well for our global customer base and thus for our investors.”

Netflix benefits from “data network effects” since the more people who use Netflix, the more data they have and the better the recommendation systems get. Matt Turck writes:

“Data network effects occur when your product, generally powered by machine learning, becomes smarter as it gets more data from your users. In other words: the more users use your product, the more data they contribute; the more data they contribute, the smarter your product becomes (which can mean anything from core performance improvements to predictions, recommendations, personalization, etc. ); the smarter your product is, the better it serves your users and the more likely they are to come back often and contribute more data – and so on and so forth. Over time, your business becomes deeply and increasingly entrenched, as nobody can serve users as well. Data network effects require at least some level of automated productization of the learning. Of course, most well-run businesses “learn” in some way from data, but that’s typically done through analytics, with human analysts doing a lot of the work, and a separate process to build insights into the product or service. The more automation you build into the loop, the more likely you are to get a flywheel effect going. Google is a classic example of data network effect at play: the more people search, the more data they provide, enabling Google to constantly refine and improve its core performance, as well as personalize the user experience. Waze, now a Google company, is another great example, essentially a contributory database built on data network effects. There are also plenty of examples of data network effects found at the feature (rather than core business) level: for example, recommendation engines that are now everywhere from Amazon (products you’ll want to buy) to Netflix (movies you’ll want to watch) to LinkedIn (people you’ll want to connect with), and keep getting better with more users/data.

In addition to the demand-side economies of scale (network effects) just discussed, there are also supply-side economies of scale that benefit Netflix’s business. In other words, Netflix benefits from the size and scale of its operations, with cost per unit of output that decreases with increasing scale as fixed costs are spread out over more units of output. Many people have doubted this over that Netflix benefits from network effects and supply side scale economies over the years. Dredging a few headlines up is useful and entertaining:

“Why Comcast will Crush Netflix” from 2012 in Fast Company

“Lessons from the Strategy Crisis at Netflix” from 2016 in Strategy +Business

“Netflix: Sell, Sell, Sell” from 2017 in Seeking Alpha (of course the link no longer works)

As I have said many times, I will not do a valuation for readers of this blog of a stock and that includes Netflix. It would not be helpful for me to give stock “tips” in this blog since it encourages terrible behavior, particularly among people whom it can harm the most.

Netflix’s competitive position has produced a stock valuation that is quite attractive to say the least. The last time I checked NFLX was trading at ~265.

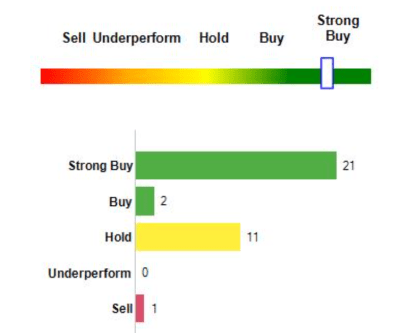

Even though I will not provide a stock tip people will be able to find them anyway from the usual mob of Wall Street sell-side analysts. Their views are depicted here in a graphical format:

Oh, you say you want a specific prediction from these sell-side analysts? Well there are many to choose from such as:

As two example of a sell side analyst predictions, MKM Partners analyst Rob Sanderson recently raised his 12-month price target on Netflix to $320 and BTIG analyst Rich Greenfield has a $330 price target. Opinions on the Netflix stock price are like belly buttons, everyone has one! It is easy to find one that fits with a preconceived notion on valuation unless it is to sell. There is one lonely analyst says NASDAQ and one other source I saw said there are actually three.

Some people reading this blog post will inevitably jump up and down about Netflix’s P/E multiple and other ratios. “The P/E ratio is too high!” they will exclaim. This jumping up and down is good exercise for them (it has cardiovascular and other health benefits). I will not take a position on whether the current NFLX stock price is too high or too low. I will say that I would make my analysis based on future absolute dollar cash flows and not current accounting earnings, especially since since it is a rapidly growing subscription business. I believe that accounting earnings are a lousy way to evaluate a business since I am an advocate of the approach suggested by Michael Mauboussin (the co-author of the book Expectations Investing): “Management can achieve earnings growth not only when it is investing at or above the cost of capital but also when it is investing below the cost of capital.” Mauboussin’s view is:

In making an assessment of Netflix these “up and down jumpers” that have love for PE ratios (CAPE!) should keep in mind while they are improving their fitness that Netflix’s streaming business = servers mostly from third party provider, people, customer data and algorithms. Netflix is fundamentally a software-based platform. In valuing a company like Netflix it is wise to recall that it does not make its growth investments in assets like video stores which can be depreciated over time under accounting rules. A software-based services company like Netflix is investing in assets like machine learning systems that create better sales funnels (lowers customer acquisition cost), machine learning systems (improves customer retention) and algorithms that reduce the amount of bandwidth required to stream video (increases gross margin and retention). Each of these types of software improves the unit economics of Netflix’s business and helps create a competitive advantage. BTW, Netflix is a software business. Is Hulu a software business? Is HBO?

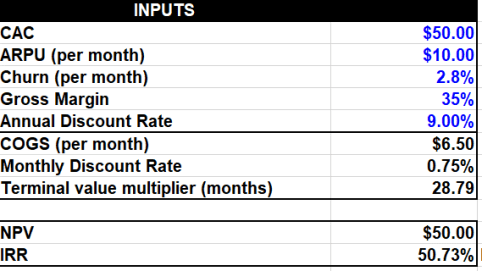

Some readers of this blog may be asking about now: “Can’t you at least give us a little more guidance?” I can suggest that they look at the Netflix unit economics using tools I have discussed before on this blog. This will give them a bottoms up view that they can reconcile with their top down analysis in their search for greater forecasting accuracy. Here is one set of Netflix numbers based on some educated guesses about inputs into LTV like churn and customer acquisition cost:

Here is another version:

There are a massive number of combinations you can consider by changing the variables in blue in a spreadsheet. How much can Netflix raise prices and what would the impact be? What would churn be in the business if a recession started? Will gross margins change over time? How many subscribers can Netflix can generate? You can do your own math using your own assumptions and your own spreadsheet. Doing this sensitivity analysis is a lot of work, but investing isn’t supposed to be easy. If investing was easy, everyone would be rich.

The rest of my blog post on Reed Hasting and the end notes for this post will appear next week since this is getting to be too long already. I have the data that says that many of the people who start an essay like this will have quit by now. An essay of 7,000 words would have been a bridge too far. Thanks for reading if you are still here.

- Lessons from Phil Knight about Business and Being an Entrepreneur

- Business Lessons from Reed Hastings/Netflix (Part 2)

Categories: Uncategorized