Businesses increasingly don’t just sell products and services in a single transaction. Subscription and other businesses that focus on recurring sales have existed for a very long time. What is new is that many more businesses have adopted a subscription approach, which makes them look a lot more like a company in the the cable television business than an auto parts manufacturer.

Successfully implementing a subscription business model can be particularly hard since the customer acquisition cost (CAC) happens up front and the revenue appears over time. These subscription businesses have a revenue profile that is more like an annuity. This revenue profile is not like the manufacturer’s business that many people learned about from a college introduction to accounting class. Unlike an annuity, the revenue stream of a subscription business is subject to risk, uncertainty and ignorance. The good news is that it is precisely because there is risk, uncertainty and ignorance that an opportunity for profit exists. The bad news is that it can be hard to capture. The reality is that if you do not capture this profit your competitors may do so.

Someone may ask: Why should I worry about this? Will it be on the test? The answer is: Yes and yes. Charlie Munger says it best: “The number one idea is to view a stock as an ownership of the business and to judge the staying quality of the business in terms of its competitive advantage. Look for more value in terms of discounted future cash-flow than you are paying for. Move only when you have an advantage.” The text in bold in the Munger statement is critical with a subscription service like Amazon Prime- you can’t understand the value of the business by looking at just one month or even a few months since it is lifetime value that matters.

Why are these new subscription businesses being created more often? The economics of a subscription business can be very favorable if you get it right. A lot of financial leverage can be generated if the customer does not need to be acquired repeatedly. Customer acquisition cost is lower for a well-run subscription business even though it is more front loaded. Yes, subscription business models can have more predictable revenues, but that is not caused by the tooth fairy. More predictable revenues are a byproduct of lower overall CAC and some operational approaches and investments in customer retention. The trade-off is that a subscription business model can also be deadly if you get it wrong. Each of the key variables in a subscription business can be either: (1) many angels working together to build something wonderful, or (2) a pack of hungry wolves that can tear the business to shreds. Propelling more businesses to adopt a subscription business model is a simple truth: if your competitors or competitors get this model right your business may be doomed.

The benefits of this new way of doing business was chronicled well in the book The Outsiders by Thorndike. One of the major innovators of this way of doing business model was John Malone in the cable television industry. Here is John Malone talking about the model he used to build many of his businesses:

“We decided… to go on a cash flow metric very much like real estate. Levered cash flow growth became the mantra out here. A number of our eastern competitors early on were still large industrial companies — Westinghouse, GE, — and they were on an earnings metric. It became obvious to us that if you were going to be measured on earnings, it would be real tough to stay in the cable industry and grow.” “I used to say in the cable industry that if your interest rate was lower than your growth rate, your present value is infinite. That’s why the cable industry created so many rich guys. It was the combination of tax-sheltered cash-flow growth that was, in effect, growing faster than the interest rate under which you could borrow money. If you do any arithmetic at all, the present value calculation tends toward infinity under that thesis.” “It’s not about earnings, it’s about wealth creation and levered cash-flow growth. Tell them you don’t care about earnings..” “The first thing you do is make sure you have enough juice to survive and you don’t have any credit issues that are going to bite you in the near term, and that you’ve thought about how you manage your way through those issues.” “I used to go to shareholder meetings and someone would ask about earnings, and I’d say, ‘I think you’re in the wrong meeting.’ That’s the wrong metric. In fact, in the cable industry, if you start generating earnings that means you’ve stopped growing and the government is now participating in what otherwise should be your growth metric.”

The more you understand about what John Malone has accomplished in his business the more you will understand what companies like Amazon are doing in their business.

To help entrepreneurs, shareholders and lenders understand whether a given business is generating what Charlie Munger called “more value in terms of discounted future cash-flow than it is paying for” it is more than useful to calculate what is known as “unit economics.” I have written a post before about unit economics, but in this blog post I focus more on examples.

Bill Gurley sets the stage:

“[Understanding] the actual unit economics in the underlying business…requires analyzing the ‘true’ contribution margin of the business; not simply looking at gross or net revenue and the proper contra-revenue treatment, and not even looking just at gross margin as defined by the company. Many companies embed costs that are truly variable (for instance customer support, marketing, credit card processing) below the gross margin line. If you want to know if the business model truly hunts, you must pay careful attention. Otherwise, you may have simply found a company that is simply selling dollars for $0.85.”

These five factors determine the “unit economics” of a business:

- a customer acquisition cost (CAC);

- an average revenue per user (ARPU);

- a gross margin;

- a customer lifetime (which is a function of customer retention/churn); and

- a discount rate.

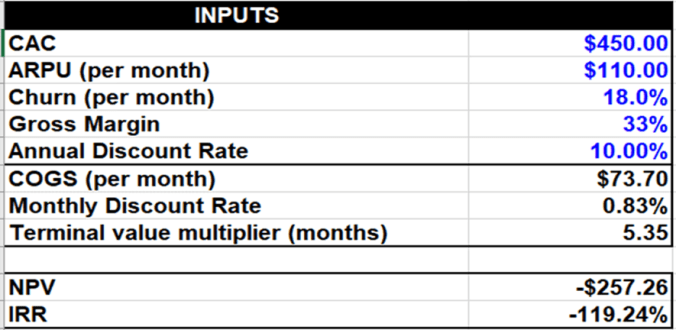

Let’s work though a key sensitivity using a fictional example. Imagine there is a business with the name “Green Oven” that delivers the food components for cooking meals along with recipes (i.e., food Legos for adults). Assume Green Oven’s unit economics look like this:

Average revenue per user (ARPU) per month – $110

Gross margin – 33%

Monthly customer churn – 18%

Customer acquisition cost (CAC) – $450

Discount rate – 10%

The lifetime value of a Green Oven Customer would look like this:

That set of numbers above obviously produces an ugly lifetime value. What would happen to Green Oven’s unit economics if the rate of customer churn could be reduced to 7% a month?

Making this comparison (often called a sensitivity analysis) reveals that retention is an important factor for Green Oven. Another important sensitivity to model is the impact of a lower customer acquisition cost (CAC). Let’s take it down to $300 and assume churn is 10% in another sensitivity calculation. The numbers look like this:

It is useful to play around with a lifetime value spreadsheet and do numerous sensitivity runs to get a “feel” for how the variables interact in a given business. In this case of the Green Oven the high CAC makes high churn a potential business killer. Green Oven needs to be laser focused on reducing CAC, so it can better handle churn.

When a business reports an input into lifetime value like CAC or churn it is often an average. That may hide the fact that there are big differences in the analysis by “cohort.” A cohort is a collection of customers who share an attribute or set of attributes. For example, one type of a cohort is those customers who subscribed to a service in a given month.

Managing customer lifetime value for a business isn’t simple as David Skok writes:

“If you’re an early stage SaaS startup, still trying to get product/market fit, or experimenting with different ways to make your marketing and sales predictably repeatable and scalable, it is useful to play around with CAC and LTV to get a feel for where you are. But it’s important to note that these formulae will only yield meaningful results when your sales and marketing process and costs are predictable and scalable. Instead of spending too much time obsessing over CAC and LTV, rather focus your energies on solving the problems of improving product market fit, and making your customer acquisition, repeatable, scalable and profitable.

My apologies that there are some complex looking formulae in this article. We have provided a summary below of the key concepts, and a link to jump straight to the spreadsheet to model your own LTV. For those interested in understanding the theory behind this model, we provide our usual detailed explanation below.”

Making management of lifetime value is hard for an entrepreneur in no small part because the lifetime value variables change based on other factors like the sales channel used or geographic factors. A business can start out with very high CAC and then have it it drop over time (XM Sirius or Netflix) or have relatively low CAC and watch it rises over time (Blue Apron it appears). You can see the impact of these changes yourself by using Skok’s spreadsheet in the link to perform your own sensitivity analysis.

Why might CAC drop? There are many possible reasons including improved core product value over time, less competition, a booming economy and rising incomes, or a better sales funnel. Spending money on a growth hypothesis before a value hypothesis is a classic way to suffer horrific churn. Nothing reduces churn more than a more delighted customer. Nothing makes it worse the an unhappy customer telling other people about their unhappiness.

- “If the dogs don’t want to eat the dog food, then what good is attracting a lot of dogs?” Andy Rachleff

- “If you make customers unhappy in the physical world, they might each tell 6 friends. If you make customers unhappy on the Internet, they can each tell 6,000 friends.” Jeff Bezos

- “The key is to set realistic customer expectations, and then not to just meet them, but to exceed them – preferably in unexpected and helpful ways.” Richard Branson

Why might CAC rise? There are many reasons this could happen including but not limited to greater competition, a recession, or the need to move into new market segments as the early mark segments become fully penetrated. Amy Gallo writes in a Harvard Business Review article:

“Often a high churn rate is the result of poor customer acquisition efforts. “Many firms are attracting the wrong kinds of customers. We see this in industries that promote price heavily up front. They attract deal seekers who then leave quickly when they find a better deal with another company…Before you assume you have a retention problem, consider whether you have an acquisition problem instead.” “Think about the customers you want to serve up front and focus on acquiring the right customers. The goal is to bring in and keep customers who you can provide value to and who are valuable to you.”

A cohort analysis might look like this when graphically presented (another David Skok example):

In the title of this blog post I said that I would explain how to value an Amazon Prime Subscriber. If you think about Amazon Prime as an annuity (i.e., in terms of lifetime value) it might look like this below:

This LTV calculation for Amazon Prime is based on one set of assumptions by one analyst based on incomplete information. The assumptions for Prime used by this analyst are:

ARPU: $193 a month

SAC: $312

Gross margin 29%

Churn 0.6% (customer life 167 months or ~14 years)

Discount rate 9%

You can use your own variables and David Shok’s spreadsheet (or your own) in conducting a lifetime value analysis rather than relying on Cowen. Not looking at lifetime value at all is a huge mistake. A company like Amazon is not understandable if you believe its business model is similar to the steel manufacturer you learned about in your introduction to accounting class. Trying to value Amazon’s Prime business with a P/E ratio is like trying to open a can of corn with a pickle.

An investor can pretend they do not need to do this lifetime value math, but the result will not be pleasant. Peter Lynch famously said that an investor who does not do research is like a poker player who does not look at the cards. To understand the value of the stock of a company that is using a subscription business model you need to understand the business and you can’t understand a business like Amazon without doing this lifetime value math. I will be writing more on subscription business models in subsequent blog posts.

Notes:

Bill Gurley http://abovethecrowd.com/2015/02/25/investors-beware/

David Skok: http://www.forentrepreneurs.com/ltv/

Amy Gallo: https://hbr.org/2014/10/the-value-of-keeping-the-right-customers

My blog post on the book The Outsiders: https://25iq.com/2014/05/26/a-dozen-things-ive-learned-about-great-ceos-from-the-outsiders-written-by-william-thorndike/

My previous post on Unit Economics: https://25iq.com/2016/12/31/a-half-dozen-ways-to-look-at-the-unit-economics-of-a-business/.

My previous post on CAC: https://25iq.com/2016/12/09/why-is-customer-acquisition-cost-cac-like-a-belly-button/

My previous post on churn: https://25iq.com/2017/01/27/everyone-poops-and-has-customer-churn-and-a-dozen-notes/

A few links

On churn:

https://www.ngdata.com/what-is-customer-retention/

https://hbr.org/2014/10/the-value-of-keeping-the-right-customers

On “Green Oven” comps:

https://www.linkedin.com/pulse/detailed-look-blue-aprons-challenging-unit-economics-daniel-mccarthy

https://medium.com/@nbt/how-blue-apron-compares-to-other-subscriptions-in-one-graph-6404a74ccf2d

https://medium.com/startup-traction/blue-apron-s-1-meals-on-your-doorstep-923499bcaf45

http://www.slate.com/blogs/business_insider/2017/06/30/blue_apron_customer_retention_low.html

- How to Create a Successful Business Model in a Dozen Easy Steps [Fake advice! Not possible.]

- A Dozen Lessons on Investing from Ed Thorp

Categories: Uncategorized